There are always lots of questions, especially from First Time Buyers (FTB), as to why brokers arrange their mortgages and their home insurance and life insurance too? Why does it take so long to get a mortgage? Any why so much paperwork? And why? And why? And the questions keep coming. Especially after all the effort to get a mortgage the mortgage is declined. We thought it might be useful to put a quick article together to cover some of these questions:

What do mortgage brokers do?

Why do banks and lenders use brokers?

Brokers normally know customers better than banks

Mortgage regulation & compliance

What do mortgage brokers do?

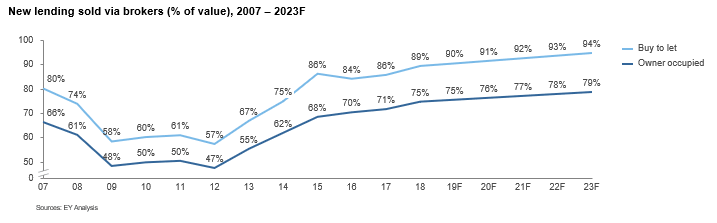

Getting a mortgage and drawing down a mortgage can take a while and can be stressful. Brokers do a lot of back and forth with the lender and borrowers wonder why banks don’t skip the broker and deal directly with the borrower? Surely it would save time? But there is a good reason why mortgage brokers arrange over 75% of all mortgages in the UK.

Why do banks use mortgage brokers?

Banks use mortgage brokers because it is more cost effective than selling within their own branches, especially for smaller banks.

Brokers also provide banks with easy access to a large volume of customers. When a bank creates a new mortgage product, they can quickly distribute this through their broker network and begin to drum up new business.

They can stop the same product just as quick when they have sufficient lending targets met.

Brokers know customers better than banks do

Also, Brokers are good at identifying which borrowers are likely to qualify for a mortgage and meet the affordability criteria. This saves banks (and the borrower) time by not having to review borrower applications that would not be approved.

Brokers also specialise in advising borrowers with unique circumstances or borrowers that require specialised mortgage products (e.g. self-build mortgages). This is often where a mortgage broker earns their commission – brokering the mortgage and hand holding the borrower through their mortgage journey.

Mortgage regulation & compliance

But the strongest argument for why brokers arrange mortgages on behalf of lenders is due to the compliance risk involved. Not so long ago when you were seeking a mortgage you visited your local bank and met with the bank manager to get your mortgage.

The mortgage product was rather straightforward and LTVs (Loan to values) were relatively low. But when regulation on mortgage products began to get relaxed in the 80's, more and more mortgage products became available from lenders (e.g. cash back, interest only, FTB only products). This increased the cost to lenders as they needed to train and retrain staff to provide advice with the inherent risk of miss-selling a mortgage to a borrower.

The Mortgage Market Review (MMR) by HM Government following the credit crunch combined with 20,000+ mortgage products available for borrowers seeking a mortgage, has saw the brokers increase the percentage of mortgages arranged by borrowers surge in recent years with the expectation by EY that they’ll arrange 80% of all mortgages in the UK by 2023.

We all wish they could do it a little faster.