Jump to:

2. When you should remortgage - is it the right choice for me?

3. When you shouldn’t remortgage - is it the right choice for me?

4. Getting ready to remortgage - What you need to know

5. Boost your chances of getting the best mortgage deal

6. Remortgaging if you're self-employed or a contractor

7. What type of remortgage is right for me?

8. Moving house - Porting a Mortgage

9. What are the fees involved with Remortgaging?

10. Additional add-on remortgaging fees to watch out for

11. How to get the best remortgage deal

12. Key Questions to ask your broker

13. Steps to the remortgaging process with a Mortgage Broker

1. What is a Remortgage?

Remortgaging is when you look to move from one mortgage to another mortgage deal with a new or existing lender, while remaining in the same property.

For example. Before you upgrade your phone, swap contracts or switch credit cards to better terms, you do your research and shop around for the best offer. Could shopping around for a better mortgage deal benefit you?

A mortgage is most likely to be your biggest and longest financial commitment, lasting on average for 25 years. Over that time, your circumstances will likely change, leaving you requiring more space, home improvements or debt consolidation. That’s life!

These are all reasons that someone might look to Remortgage.

Remortgaging is a way to release some money, but only if you understand when the time is right.

2. When you should remortgage - is it the right choice for me?

1. You could Remortgage if: The end is near if you are coming to the end of your current mortgage deal

Some of the best mortgage deals only last at a fixed rate of 2-5 years. So if your current deal is coming to an end, remortgaging can stop you from being automatically placed on a Standard Variable Rate (SVR) mortgage.

SVRs are often higher than your old interest rate and also higher than current best buys. If this suits you, it’s suggested that you may want to start looking into remortgaging around 14 weeks before the end of your current deal.

2. A better mortgage rate is out there

If you’ve been doing some remortgaging research and found a better mortgage rate to switch to, you’ll have to pay an ‘early payment charge’ plus an ‘admin’ or ‘exit’ fee.

Early payment charges can be quite large, on avg. they’re 2-5% of your outstanding loan.

That being said, the savings of getting a better rate can be huge and outweigh this initial fee massively in the long run.

3. Your home’s value has significantly increased

You might find you’re in a low Loan-to-Value band if your property’s value has risen significantly. If so, you may be eligible for a lower mortgage rate.

You can estimate your property value (for free) through the following property valuation calculators:

Remember to take the evaluation as a suggestion. For a firmer idea, discuss your property value with an FCA approved Mortgage Advisor.

4. You’re worried about interest rates rising

Depending on the type of mortgage you have, base rate changes can affect your payments - though not always. Follow up with an FCA authorised Mortgage Advisor to find out if raising interest rates affect you.

5. Your lender won’t let you overpay

Have you inherited money or received a pay rise, and you want to make an overpayment on your mortgage and your current deal won’t let you? Here is what you can do…

You can Remortgage to another deal that gives you this option and payoff some of the mortgage and receive a reduced loan. You may even get it at a better rate!

Before remortgaging, do your research on any exit fees or early repayment charges and decide if paying these now will save you money with a new, lower mortgage loan.

6. You’re swapping from ‘interest-only’ to ‘repayment mortgage’ (in that order)

Your lender should be able to help you change from an interest-only to a repayment mortgage.

You don’t have to swap over completely; you can swap a portion of the loan to your repayment and leave some on the interest-only agreement.

7. You’re borrowing more for your mortgage

If you want to borrow more for your mortgage but your current lender has denied your offer, or given you terms you weren’t expecting, remortgaging with a new lender can be an option.

You may be able to get a low-rate loan deal. Remember to research before deciding to Remortgage, check your current deal for exit fees and look into other options of borrowing.

The new lender might ask for evidence of what the money's for. The most commonly accepted reasons are ‘for home improvements’ or ‘paying off other debts’. Evidence can include invoices or building plans from construction workers or other debts you have paid off.

8. For flexibility

Say you want to go traveling, you’re settling into a new job, or perhaps you’re returning to education - some mortgages will accommodate this and enable you to miss a mortgage payment (which is known as a ‘payment holiday’.)

Although bear in mind that flexibility comes with a price of its own - in higher interest rates. So making sure that your reason for getting mortgage flexibility is suitable is key to sustainable finances.

Multiple mortgage flexibility options are available depending on your situational requirements.

3. When you shouldn’t remortgage - is it the right choice for me?

Three things that are important when considering remortgaging:

- Money

- Timing

- Your Personal Circumstances.

When money-saving ideas are running around your head, you might think remortgaging is the only answer or at least a quick fix.

But with the cost of remortgaging being quite high, you really have to consider whether the long-term savings of a new deal is outweighed by potentially huge upfront fees.

Why shouldn’t I Remortgage?

1. I already have a great deal

If you’ve looked into it and discovered that your deal is the best one available, then you shouldn’t need to Remortgage. There’s no harm in checking your deal to make sure you’ve got the right one for your circumstances and that it will last you into the future.

2. My terms include penalties

If you’re in a deal with extremely high penalties for changing during the incentive period, it might be damaging to your finance to Remortgage before the end of the contracted terms.

If you have done your sums and decided you definitely still want to get out of your current deal, you can ask your lender if they would allow you to change by paying an ‘early repayment charge’.

It might mean you have to pay penalties plus a repayment charge but at least you will be on a new deal with better monthly charges.

3. Current rates are fashionable

Mortgage rates can increase and decrease due to the Bank of England’s base rate, lender’s competitiveness and the financial market. Whilst rates are currently low (Jan ‘21), there’s nothing to say they won’t rise up in the future.

Fixed-rate mortgages allow you to remain on the same rate for the agreed period, usually 2-5 years before placing you onto an SVR (standard variable rate) - where your rates will still fluctuate with the BoE (the Bank of England).

4. I own 10% or less of my property

If you own less than 10% of your property, remortgaging won’t be easy or cheap. The reason for this is that you’ll potentially need to borrow around 90% of your current property value before trying to find a new mortgage deal.

High mortgage deals (90-95%) are increasingly becoming popular for those who are buying a house for the first time, but these offers are not aimed at those who are remortgaging (as their rates are high and can change!)

5. I’m in negative equity

You may find yourself in negative equity if the market value of your property is less than the amount remaining to pay on your mortgage. (And you still have to make repayments.)

What you can do is ask your lender if they can extend a better rate to you, try to make overpayments when you can (check if any fees are charged for this) and wait for prices to rise again in your area.

6. If your personal circumstances have changed

If your financial position has changed e.g. you’ve become self-employed or your partner has left work, you could face Remortgage difficulties. This is because you mightn’t fit a new lender’s criteria, making it less likely for them to offer you a loan. So it may be better to stay where you are for now. Consider speaking to your lender about new payment terms or discuss options with an FCA approved Mortgage Broker.

7. I have a bad credit history

The lingering of bad credit history can follow you around, including when you’re remortgaging.

Since the credit crunch, lenders are more ‘choosy’ about who they lend to now and are less likely to give a loan to someone with a bad credit history. E.g. someone who misses payments on credit cards, store cards, loans, utility bills, mortgage payments etc.

Lenders want customers who have clean credit records and can show they handle their debt well.

Read our 5 Tips from Mortgage Brokers for Bad Credit Remortgages

8. I have a small mortgage left

You’re less likely to save any money if you are being charged high fees because of remortgaging with a new lender - even if you only have a small amount left to pay on your mortgage.

Some deals charge a 4-figure fee to Remortgage. So if the amount you owe is around £50,000 or less, you might actually save money by staying in your current deal rather than putting yourself out of pocket for a new deal with high fees.

4. Getting ready to remortgage - What you need to know

Before you dive into remortgaging, answer these three points based on your current mortgage deal:

1. Do I have to pay an early repayment charge?

Check the fine print. Commonly, mortgages include an early repayment charge during the initial period - some have extended penalties that apply after the end of the deal. So if you Remortgage, you will trigger these payments and could be charged thousands. Before you continue find out:

- Do I have an early repayment charge?

- How much is the early repayment charge?

- What date does it apply to?

After you have this information, you can work out if paying the charge is worth ending your deal early.

If it’s not, at least you now know the exact date the charge applies to, so you can plan to Remortgage for the next working day and save yourself money!

2. Will you pay an exit fee?

An exit fee or an administration fee is used to release any deeds over to your solicitor. They usually cost around £50 - £200 and should only be charged to you if you were told about them when you first got your mortgage.

They can be found in your offer document and Key Fact areas. If you can’t find it in your documentation or have never had it pointed out to you, you can ask for the fee to be removed.

3. How much do you currently owe your lender?

This information is used to calculate how much you’ll need to Remortgage for. The best way to find this out is to phone your lender and ask them, “if I wanted to clear my mortgage by 1st of September 2021, how much would I need?”

Including a date helps to include all repayments you have to make between now and then so no figures are being made up or left out of the total amount. A rough estimate could botch your figures and leave you getting a higher-priced deal than you require.

5. Boost your chances of getting the best mortgage deal

The criteria for borrowing money has never been so tight, as today’s lenders want to be absolutely positive of your affordability and background before they agree to give you any sort of loan, especially if it’s for a mortgage.

There are many ways to shape up your profile, show your reliability and improve your chances of getting the best mortgage.

Find out how to boost your chances of getting the best mortgage deal.

1. Improve your credit score

You can improve your credit score by doing the following:

Prove residency by getting on the electoral roll (go to www.gov.uk/register-to-vote).

Foreign nationals can add a note on their credit profile stating their address/residency.

Check your current credit score file from all three credit agencies. Equifax, Experian and CheckMyFile.

Lenders use the combined average of these scores to represent you so it’s important to gather all three. And they’re also free.

If a credit agency tries to charge you for getting your report, don’t use it as these only show slight indications.

Check through your file for any mistakes. If you find an error, ask your lender to correct it. If the lender doesn’t remove the error, you can add a ‘notice of correction’ to your file - explaining the circumstances and why it’s unfair not to remove it. If the agency won’t help you, contact the Financial Ombudsman (UK & NI) who will process your complaint.

Check all addresses on your file even if it’s an old account or a contract you don’t use anymore. Lenders will worry over small, unusual details like this. Forgetting to update addresses could risk the acceptance of your application.

Breakup with past finances. Did you share a house at University? Live with your Ex? Then there’s a chance your old roomie’s credit score might be affecting yours today.

You need to contact any credit agencies you linked up with and ask to be ‘de-linked’ from them. This will stop any affiliation of their credit history and your application.

Build and Re-build your credit score. Do you currently have bad credit? Check out Money Advice’s blog on how to rebuild it, including using a Credit Builder Card.

You can start to build your credit score by using credit (getting a credit card or a loan) and paying it back responsibly. Read Experian’s report on How to Build Credit.

Time your application to your advantage. Unpaid bills and previous court judgments can get wiped from your record after 6 years. So you could wait until these have cleared to boost your chance of getting the best mortgage deal.

Pay everything on time. If you can, don’t miss any payments. You will really boost your chances of getting the best mortgage deal.

Set up a direct debit to make minimum credit card repayments on time every month. You can always pay more when possible - this looks good on an application!

Keep your eye on the prize. In the leading months, focus your attention on only one application - your mortgage deal. All applications go on your credit file so it would be sensible to space these out when you’re applying for a mortgage deal. Otherwise, you risk your application appearing irresponsible as you search for credit quickly.

Never withdraw cash on your credit card. Only live within your budget, remember your credit card is only there to show you’re responsible. Withdrawing cash is noted on your credit file and it’s expensive to do so. Avoid this at all costs!

Don’t reapply if you’ve just been rejected. Check your file for any errors before applying again. Rejections affect your credit rating so apply with care.

2. Prove Your Affordability

Lenders want to see polished details of affordability before they accept any deals. Follow these steps to prove your affordability and boost your chances of getting the best mortgage deal.

Use a broker to find the right deal for you. They have information that the public doesn’t see e.g. the lender’s credit and affordability criteria, so they will help match you up quicker than you going at it alone. Using a broker can also get your application accepted easier and quicken up the whole process.

Read our blog on Questions to ask your Mortgage Broker.

Get proof of your income because lenders need evidence. Previous bank statements and payslips work, look at the last three months. You’ll also want to make sure that the money going into your account matches up with the outgoings you’ve described e.g. car insurance, phone bill.

Inspect your bank statements, thoroughly. Ask yourself, “Is there anything on here that could be seen as a red flag to my lender?” Overdrawn charges and overdrafts can be ‘deal breakers’. Check your list of outgoings against your bank statement, as these will have to line up.

Prepare to explain any unusual activity to your lender. They’ll want to know the reason for unidentified direct debits or standing orders to your Mum. Your application can be rejected if you fail to provide a reason.

Draw up your Disposable Income. This is the amount of money you have left at the end of each month. The bigger the figure, the more likely a lender is to see your affordability and get you the best deal.

Minimize your expenditure for at least three months before you apply for your deal. This will boost your disposable income and clearly show it on bank statements. ‘Fine tooth comb’ your bank statements to identify where you can cut costs. Maybe make your coffee and lunch from home instead of buying it from a shop when you’re out, cut down on petrol and walk or cycle more - this style of thinking is key to cutting costs.

Ensure you’re ‘Stress Test’ approved. Lenders will stress test your affordability to make sure your disposable income is enough to cover your best deal mortgage if rates were to jump up 7-8%. Try this Mortgage Rate Calculator.

3. More tips to boost your chances of snagging the best mortgage deal

An extra £100 can boost your acceptability. This means you can reduce the amount you need to borrow by 0.1% and cuts paperwork for the lender. An extra £100 on your deposit can speed up your application process with ease.

Overdraft? Never heard of it. Keep out of your overdraft. It’s known that lenders see those who ‘live close to the edge’ of their overdraft limit as financial risks and this can provide enough reason to reject an application. Try not to use it if you want to boost your chances of getting the best deal.

If you can get out of your overdraft - do. Some lenders don’t even like to see any overdraft availability on accounts within the last three months prior to an application. If you have an overdraft with a credit card, you can look into 0% Money Transfer Cards here.

Avoid PayDay Loans. They show poor money management and have extremely high-interest rates. Lenders will most likely reject your application if you have a Payday loan.

Terminate your unused credit cards. If everything’s paid off and you’ve researched the fine print of closing credit cards. There’s no need to have credit waiting around ready to be used on a ‘whim’. Do make sure to complete your research as different credit cards can have their own effect if closed.

Use your savings to reduce the amount of loan needed and reduce your monthly repayments.

6. Remortgaging if you're self-employed or a contractor

Remortgaging can be a little bit more tricky when you’re self-employed, and there are a few things you need to know before you proceed with a remortgage application.

Most importantly, you’ll need proof of your income.

Examples of proof of income for self-employed include; up to 3 years of business accounts or financial records signed off by an accountant, or proof of your tax returns over the previous two years.

You’ll also need to be able to show that you have a good credit history and that you have future work planned, It’s a good idea to have proof of future work contracts or your future income, as this will help your application.

This means that if you’re newly self-employed, you might need to wait a while before applying to remortgage.

Using an FCA approved mortgage broker who specializes in self-employed remortgages can really help the process.

7. What type of remortgage is right for me?

There are a variety of options for a remortgage deal.

Fixed-rate mortgages - This type of mortgage deal means that your repayments are fixed. Even if interest rates change, the payments you make won’t go up. You can fix a mortgage for 2-10 years, but long-term security is often more expensive. Think of a fixed-rate mortgage like an insurance policy. Your prices won’t change, and this can help give you peace of mind.

Variable-rate mortgages- This is different to a fixed-rate mortgage, as your mortgage rate can move up and down, depending on interest rates.

Variable rates fall into four categories:

1. Trackers - This rate tracks a fixed economic indicator. This means that only economic change can move your mortgage rates. But, this means if interest rates rise, so will your mortgage.

2. Standard Variable Rates (SVR) - The rate you go to when your introductory fixed or tracker offer deal has ended. These are rarely available to new customers.

3. Discount Rate - Deals that offer a discount off an SVR for a short period, usually two or three years.

4. Capped deals - A rare option, where your variable rate has a safety cap so it can’t rise above a certain limit.

A mortgage adviser can help you assess your current deal, to help you make the right choice for remortgaging based on your own personal circumstances.

8. Moving house - Porting a Mortgage

Moving house doesn’t always mean you need a remortgage, or a new mortgage. You can move your existing mortgage with your new home. This is also known as ‘porting.’

Porting is useful because you will not need to pay any exit fees. In addition, since you’re most likely keeping the same terms in the lender, and you won’t need to go through the whole mortgage application process again.

However, not all mortgages are portable, so it’s worth checking up with your lender, or checking your mortgage paperwork. Even if your mortgage is portable, your lender may not let you use it.

Before asking to port your mortgage, investigate the current interest rates and shop around, to see whether you have the best deal. If you aren’t on the best deal, it could be worth considering leaving your current mortgage and applying for a new one.

You’re also likely to have to pay a fee to ‘port’ your mortgage, such as a valuation survey fee, even if you’re porting a mortgage to a cheaper property. If your new property is more expensive, you will have to pass affordability checks with your lender.

9. What are the fees involved with Remortgaging?

There are A LOT of fees when it comes to remortgaging so, it's essential to know the costs to work out if it's worth it.

Costs for leaving your current deal:

- Early repayment charge

An early repayment charge is a penalty applied if you repay your mortgage (or overpay more than is allowed) during a tie-in period. Estimated: Up to 5% of the outstanding mortgage debt.

- Deeds release fee

Known as a 'deeds release fee' or an 'admin charge', this is to pay for your current lender to forward on your title deeds to your solicitor. Estimated around: £0 - £300.

Warning from MoneySavingExpert:

‘Lenders have been known to be extremely naughty in this area and charge higher amounts than was agreed at the outset. If it wasn't communicated in writing to you when you first took the mortgage out, your lender shouldn't be charging it.’

Costs for getting your new deal:

- Mortgage Fees

Most products have at least one mortgage fee, if not two – the mortgage booking fee and the mortgage arrangement fee.

- Valuation Fee

The good news here is that most remortgage packages give you this for free. If it's not paid for you, expect to pay around £300-£400.

- Conveyancing Fee

Legal work is required to remove the original lender's interest from the property and register the new lender. This usually costs around £300 according to MoneySavingExpert

The good news is that most remortgages include a free legal package. The only downside is that the lender will select the solicitor and chances are it is paying the bare minimum so don't expect a high-speed service.

- Mortgage Broker Fee

If you're using a Mortgage Broker, they may charge you a fee. But there are brokers who are fee-free, and it's worth using one to save yourself money.

Where you pay a fee, it can be anything from a fixed fee of £300 to 1% of the loan amount (£1,000 per £100,000), which can be expensive.

What you pay can also depend on whether the broker is going to keep the commission it gets from a lender. A good broker may be willing to reduce your fee if they are getting a decent amount of commission. Always ask.

- Your new mortgage repayments

To work out your exact monthly payment for your new mortgage, you need to know the rate you'll be applying for. But if you haven't even started looking yet, you can use a best buy table to benchmark a realistic rate.

10. Additional add-on remortgaging fees to watch out for

Some lenders and brokers try to make money elsewhere in the mortgage process. Watch out and be prepared for the hard sell on the following:

Life cover from your mortgage seller

Just because one person sold you a financial product, doesn’t mean they will automatically get you good extra deals like your life cover and other insurance. Make sure not to rush and take your time to find the best offer out there as you can save 50% on the life cover sold by your lender or broker.

Mortgage Payment Protection Insurance (MPPI)

MPPI covers your mortgage payments if you have an accident, become ill and can’t work, or are made redundant.

An important thing to consider is how would you manage to meet your repayment in these circumstances.

It’s sensible to consider since there is limited help from the Government.

MPPI is quite a pricey policy but it is not a bad policy. Be extra careful if you are self-employed, at risk of redundancy, or have any medical conditions.

If you decide to take out an MPPI policy, check carefully:

- That it will pay out if you claim

- When you are covered (you may have to wait several weeks before the policy kicks in)

- How much it’ll pay, for how long, and when (it’ll usually only cover your mortgage repayments for 12 or 24 months and you’ll probably have a period after claiming before it starts to pay)

Be careful when buying MMPI from your mortgage broker. They may not be able to get you the best-priced policy and it’s quite common for a broker to offer mortgages from all lenders, but then be tied to a single insurer or a small panel of them.

11. How to get the best remortgage deal

Ideally, people will start searching 14 weeks before they want to remortgage, but don’t be worrying if you start later. The remortgaging process can be pretty quick, somewhere between six to nine weeks.

We do suggest starting earlier as some lenders only allow you to apply and hold the rate for 3-6 weeks before completing.

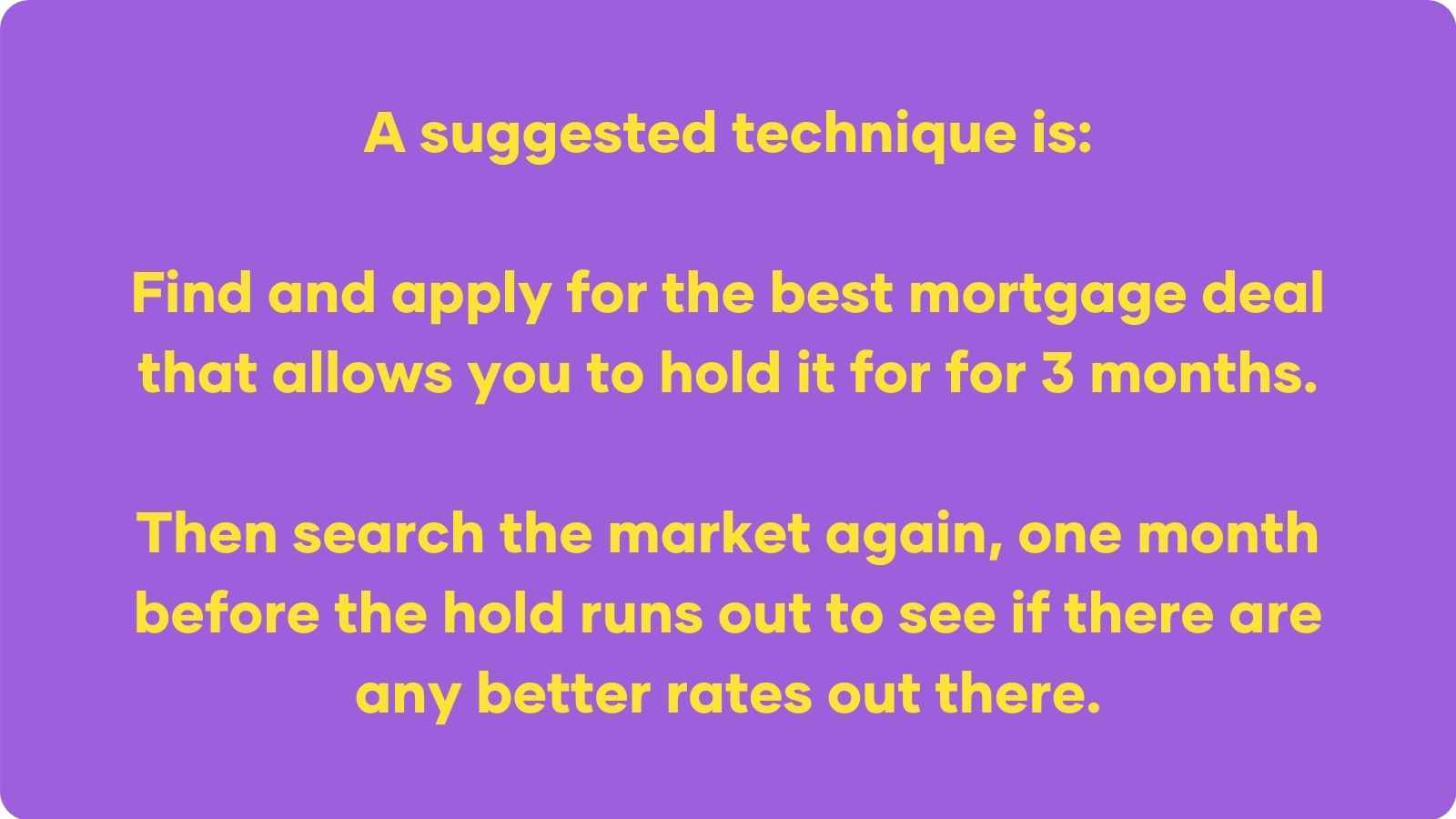

The technique is to find the top mortgage that you can hold for 3 months and apply for that, then search the market again for one month before to see if there are any better rates out there.

Ask your current lender what it will offer

Some lenders have a range of mortgages called ‘product transfers’ that are specifically designed to keep borrowers who are considering leaving. Most lenders probably won’t advertise them but it’s always worth asking the question. As a product transfer is not a remortgage, you’re just changing the terms of your current deal. It’s usually a very quick and straightforward option and may have lower fees.

Your bank might be keen to increase its share of the mortgage market so might be willing to offer you a special deal, seeing as they know you well. However, don’t be too hopeful here, but if you don’t ask, you don’t get it.

Using a broker

A broker is a qualified and regulated mortgage adviser. Basically, they save you having to thrall through deal after deal to find the cheapest one for you. You don’t have to use a broker. If you are confident and prepared to do the work and research yourself then you can do it alone too.

12. Key Questions to ask your broker

Remortgaging can feel complicated. Hey, there’s a lot to it. Thankfully there are people that look after all of the confusion on your behalf. Mortgage Brokers!

Unless you’re very well read up on the subject of remortgaging, and feel very confident about navigating those financial twists and turns, most remortgages will look to a Mortgage Broker for assistance.

Here’s some key questions to get you started when first speaking with your Mortgage Broker about remortgaging:

- What is a remortgage?

- Is it a good time to remortgage?

- Are there fees involved when remortgaging?

- Should I consolidate my debts?

- How much equity do I need in my property?

- How much of a credit rating will I need?

- What type of mortgage do I want?

- How do I remortgage my home?

Also:

“Do you check all the lenders?”

Some mortgage brokers are tied to one lender or a small panel and we’d dodge those.

The real choice is between one who checks all the lenders that work with brokers and ones that check all those plus the few extra ‘direct-only’ deals that brokers can’t set up for you.

The first type has the advantage that some of them are fee-free. For the second type, while you may have to pay, you get a belt and braces service, so every possible deal is looked at. Remember to factor this cost in when deciding whether or not to remortgage.

“How will you make your money?”

As mentioned earlier, brokers can make money in two ways:

Receiving a procuration fee from the lender. This is roughly £350 per £100,000 of the mortgage. It doesn’t affect what you pay.

Charging you a broker fee. If your broker does charge you a fee, this can be anywhere between £300 and £1,000.

While it’s legal for them to do so, we’d avoid any broker that charges upfront or even before you complete your mortgage.

Don’t think just because a broker’s charging you, it won’t be getting a fee from a lender. If the total fee from you and the lender is over £800 and it’s not complicated by issues such as your credit history not fitting, there may be room to haggle. And as the lender fee is usually a percentage of the loan amount, that really means haggling on bigger mortgages.

Remember: You can ask your broker if you can record the conversation to listen back to later, and make sure you get your notebook out and jot down some bullet point Q&As!

13. Steps to the remortgaging process with a Mortgage Broker

Here are some steps to getting a remortgage with a broker:

Step 1 - Choose a broker. You should be told explicitly what advice will cost at what stage and how you’ll be expected to pay

Step 2 - Discuss your circumstances with the broker. They’ll recommend a deal.

Step 3 - Check direct-only deals. See if you can beat your broker with deals they can’t access. If you can discuss it with your broker.

Step 4 - Select a mortgage/accept the broker’s recommendation. The broker should recommend a remortgage deal that meets your requirements.

Step 5 - You (if you go direct) or your broker will make the application to the lender.

Step 6 - Valuation and legal work. This should take up to about two months.

Step 7 - Completion

14. Steps to the remortgaging process if you’re going solo

If you’re very confident you know what you want, there’s nothing to stop you getting a remortgage on your own, though as we’ve already explained, most people are better off using a broker.

Step 1 - Select the remortgage deal or deals you fancy. Get detailed quotes from the lender(s).

Step 2 - Add up all the fees to get a figure for the total cost.

Step 3 - Work out the cost over a set period - the length of the fixed or variable rate deal, or the life of the mortgage.

Step 4 - Check you and the property are eligible before starting the application process by contacting the lender. For example, check if your income is sufficient and whether the lender will lend on your current property.

Step 5 - If you decide to go ahead, apply to the new lender. You can speak to the lender and get advice on their range of products. Or you can apply online without advice.

Step 6 - Valuation and legal work. This should take about two months.

Step 7 - Completion.

15. Feeling ready to start the Remortgaging conversation?

Feeling ready to start the Remortgaging conversation?