Saving large amounts of money, whether for a house deposit, or anything really, is becoming increasingly difficult. UK statistics show that 40% of people between the ages of 22 and 29 years old have no savings at all, which comes at no surprise considering the current living costs and rising rent prices.

Younger generations are becoming more and more prone to month on month living as they struggle to devote a significant amount of their earnings towards saving for the future.

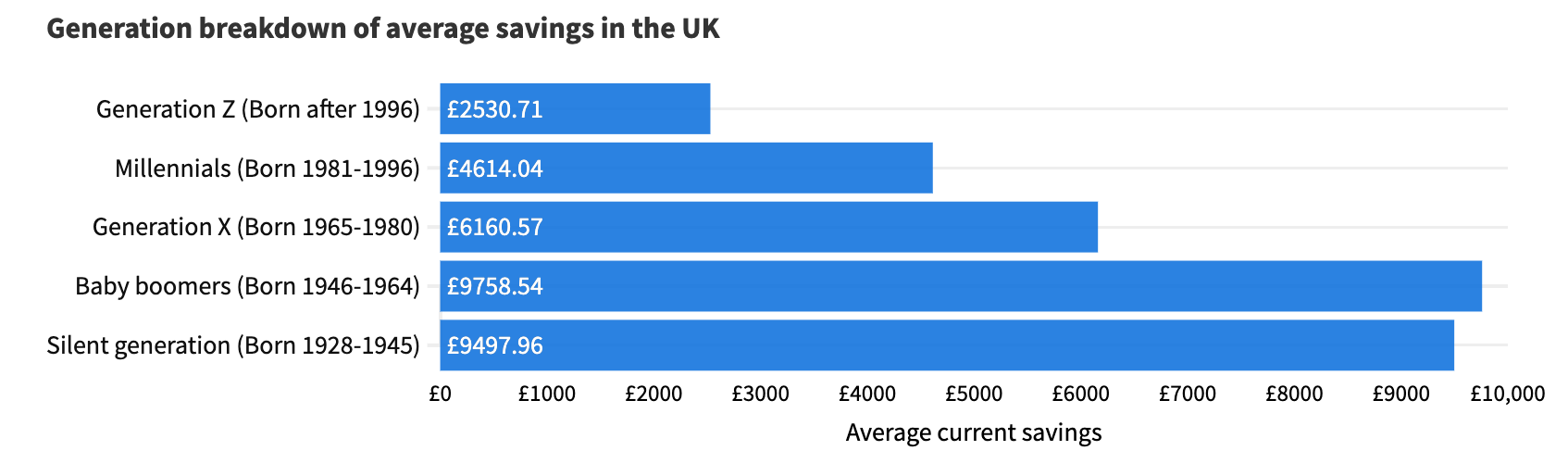

Generation breakdown of average savings in the UK from Finder.com shows a clear decline in the average amount of savings from each key generational group, from the silent generation, to generation Z:

This is caused by many different factors, such as the changing economic landscape, and a different attitude to lifestyle and money. As much as saving may be harder than it was 40 years ago, you can still easily save a significant amount of money by implementing some simple techniques.

.

How much do I save for a house deposit?

The best place to start when saving to buy a new property is to give yourself an initial goal of roughly how much you want to save before pursuing the search for your future home.

Look at current property prices and figure out how much you think you would be willing to spend. Are you certain you will want a house with a garden and multiple bathrooms? Or perhaps you are willing to settle on a smaller, cosy apartment with a balcony? Figuring out your personal needs and aligning them with a potential property type will give you an idea of the minimum amount of money you’ll need to save.

Of course, your goal amount will only be an estimation, as there is no way of truly predicting how much money you are going to be required to devote to your final deposit. First time buyers can take advantage of additional support schemes and loans available to them, such as the new mortgage guarantee scheme which allows you to borrow 95% of a property’s value, whilst only placing a 5% deposit.

This means that buyers who are eager to set foot in their own home, and want to purchase a home as soon as possible, can now do so with as little as £5000 if buying a £100,000 property, or £10,000 if the property costs £200,000 and so on.

Don’t forget, there is still a limit on how much you can borrow, which is usually dependent on factors such as your income and credit score. The rule of thumb is that single applicants, can borrow an average of up to four times their annual salary, whilst for couples the amount is usually equal to three times their joint annual salary.

Putting down a lower deposit will also have it’s disadvantages, such as potentially higher interest rates, and a longer repayment time which can further increase how much you’ll have to repay over time.

However, there is no comfort comparable to owning your own home. Knowing the money you are paying monthly is going towards something you will eventually be able to call your own make even a 5% deposit a valid choice over continuing to rent.

How to approach making a budget for a house deposit

The first step to saving effectively is to look at your net income and outgoing to formulate a budget. Take a good look at your bank statement, and filter out any areas where you believe you may be overspending each month. Have you signed up for some free trials that you have accidentally forgot to cancel? Could you maybe slash your phone or internet bill by going to a different provider?

You will be surprised at how much you can save monthly by calling up some of your service providers and asking for a cheaper price - this applies particularly to broadband, phone, and television services. Many software or service providers can often offer you great deals to retain you if you express an interest in cancelling, meaning you can easily keep the same quality of service whilst simply paying a cheaper price.

After you figure out how you can slash your outgoings, you will be able to create a realistic budget with a pre defined amount of money you know you can easily afford to save monthly. Consider following the ‘’50, 30, 20 rule’’ which encourages you to spend 50% of your net income on needs, 30% on wants, and saving the remaining 20%.

You may be keen to stash away big bucks at the start of your saving journey, but remember - you’re better off making a valid long term saving plan that you can commit to, rather than starving yourself of all of your spending money and quickly becoming bored and dissatisfied.

During your budgeting journey, simply look for cheaper alternatives that can still let you supplement and enjoy your lifestyle. If you particularly enjoy eating out - make sure to find any offers or deals that can help you slash your food bill.

If you particularly enjoy travel, try to explore local hideaways and staycations rather than going on expensive annual trips. Remember - you are working towards a goal! It will all pay off in the long term.

Consider a saving account

During your budgeting journey you should always consider opening a saving account. This will help you set money aside every month, and ensure you don’t spend it by accident. As the saying goes ‘out of sight, out of mind’ - keeping your savings beyond your current account can definitely curb any late night impulsive purchases.

A saving account does not necessarily have to gather additional interest, but if you can find one that does - you’re onto a winner. In those cases, interest can be compounded either daily, monthly or quarterly into the account at a pre-agreed rate. This means you are essentially getting ‘paid’ to save money with your bank.

Many prefer a traditional saving account which simply allows them to easily access and transfer their savings. This is a fantastic option to set money aside, and we particularly recommend setting up a direct debit into your saving account where money would be taken directly out of your current account right after you get paid.

Lifetime ISA

A lifetime ISA is a different type of saving account, which will bring you the best return on investment. Lifetime ISAs are similar to the now unfortunately expired government help to buy ISA accounts, which allowed you to save up to £200 into your ISA account monthly, with the government matching 25% or up to 3000 of your savings when you decided to buy your first home.

Lifetime ISAs work similarly, except they allow you to withdraw the money in the case of buying your first home, retiring or at a time of critical illness. You can pay up to £4000 into your lifetime ISA every year, until you’re 50 years of age. You can take out your savings at any age, as long as you meet one of the three criteria listed above, and the government will add a 25% bonus to your savings of up to £1000 a year.

This is one of the most abundant saving schemes out there, and significantly beats the amount you would earn in additional interest payments if you had an interest saving account. The fact that you can only get the 25% government bonus in the case of retiring, buying a home, or when you become ill means that you can truly devote your savings to your initial goal - saving for a deposit for the home of your dreams.

Digital Budgeting and Saving Apps

With all sorts of digital advancements it is becoming increasingly easier to spend online. By having 24/7 access to online shopping platforms, online sales in the UK increase every year, currently being the third largest in the world

As much as the development of technology has propelled our spending, new tools are also being developed every year which help shoppers save and budget.

Phone apps such as mint and plum, allow you to save money, track your spending habits and automatically set money aside in a way that will be best for you. Unlike traditional saving accounts, many saving and budgeting apps offer different, less intrusive approaches to saving, such as rounding up every purchase and saving away the remaining amount.

For example, if you were to spend £2.25, plum can round up the amount of £3 - and put your ‘change’ into savings, saving you 75p. You would be surprised how much this can add up to monthly, when done throughout multiple daily purchases.

These tools are fantastic to use when saving up for a house deposit, as they can easily increase your savings without putting you under additional stress.

Saving challenges - saving money effortlessly

Traditional saving usually brings mixed emotions - it can appear scary, tiring and tedious. Many people choose to do saving challenges, which are almost effortless, let you track you progress in real time and are probably the most fun you can have when trying to save.

Some of the easiest saving challenges include:

- The £1 saving challenge

The £1 saving challenge involves saving just £1 per day, 365 days a year. By the end of the year, you will have an additional £365, at the price of less than a cup of coffee a day!

- The 1p saving challenge

Increase the amount you save every day by 1p. Start with 1p on day one, followed by 2p on day 2 and so on. This way, in one year, you can save £667.95 in 12 months!

- The 12 month saving challenge

Starting in January, multiply the month you are in as a number by 10. Continue this pattern monthly, and you should see an additional £780 in you savings over the course of 12 months.