Jump to:

1. What exactly is a first time buyer? And who qualifies as a First Time Buyer?

2. Your affordability. Can you afford a home?

3. Boost your chances of getting a First Time Mortgage

4. First Time Buyer Deposit: How much do I need?

5. How to Save for your first time buyer mortgage deposit

6. What help can I get for my First Time Mortgage?

7. Hidden costs of buying your first home

8. What documents do I need for my mortgage application?

9. Household bills to think about when planning how much you can afford:

10. Side Hustles: Can they be included in my affordability? About Self Employed Income

1. What exactly is a first time buyer? And who qualifies as a First Time Buyer?

2. Your affordability. Can you afford a home?

You can still use the basic formula to calculate your affordability, just make sure you’d be able to keep up with repayments and have an excellent credit score, before you get your hopes up!

In Mortgage Propeller simple terms, this just means whether you can afford the repayments. They’ll not only look at your income… also your outgoings and credit score.

You can check your credit score here via Check My File, free for the first 30 days, then £14.99 a month (cancel online anytime).

3. Boost your chances of getting a First Time Mortgage

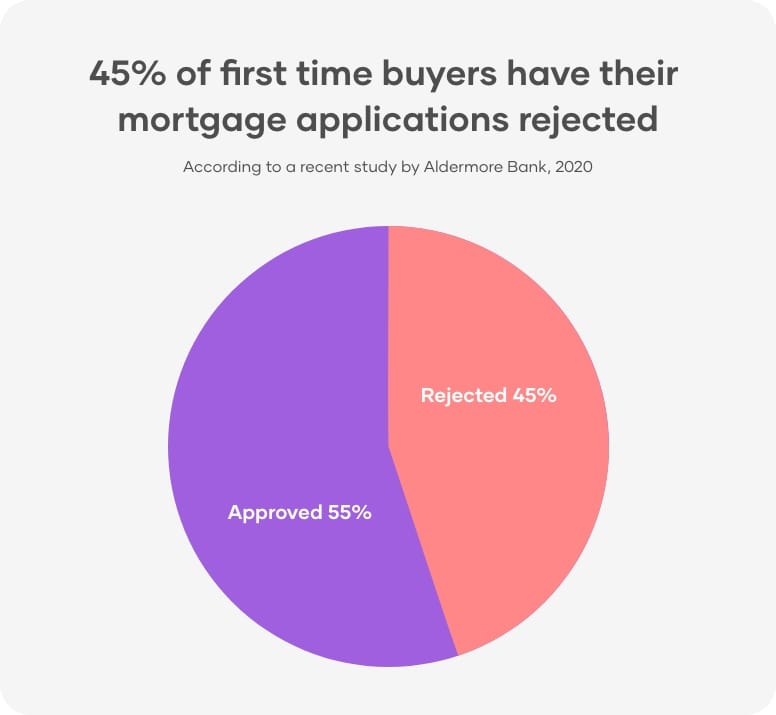

According to a recent report by Aldermore Bank, ‘45% of first time buyers have had mortgage applications rejected.’ Almost half of all first time buyers!

4. First Time Buyer Deposit: How much do I need?

5. How to Save for your first time buyer mortgage deposit

Saving up money is difficult, and can be one of the biggest obstacles in the way of you and your first-time mortgage. Like any obstacle, with research, guidance and planning it can be broken down into something more manageable.

Open an Individual Savings Account (ISA)

The government offers ISA Lifetime accounts (also known as a LISA) to those aged 18-40. This allows you to save a maximum of 4000 per year, with no tax on any interest or growth, and the government will add a 25% bonus to your savings at the end of each year.

Make a plan and organise your goals

Many first time buyers can be in denial about how much they need to save for their first mortgage deposit. Therefore, it is important to make a plan and get organised!

First, work out your affordability using a mortgage calculator to estimate how big a mortgage you can get. The exact amount will of course depend on your mortgage in principle provided by your Mortgage Broker down the line - but it doesn’t hurt to look and prepare!

I would then start to consider the deposit percentage that you can afford, it is usually between 10-15% and it can be paid over a number of months.

Third, set up a monthly direct debit into your savings account. It can seem daunting, but setting aside a bit of money after payday monthly will be worth it!

We have lost of blogs that will educate you on ways to save as a first time buyer!

6. What help can I get for my First Time Mortgage?

7. Hidden costs of buying your first home

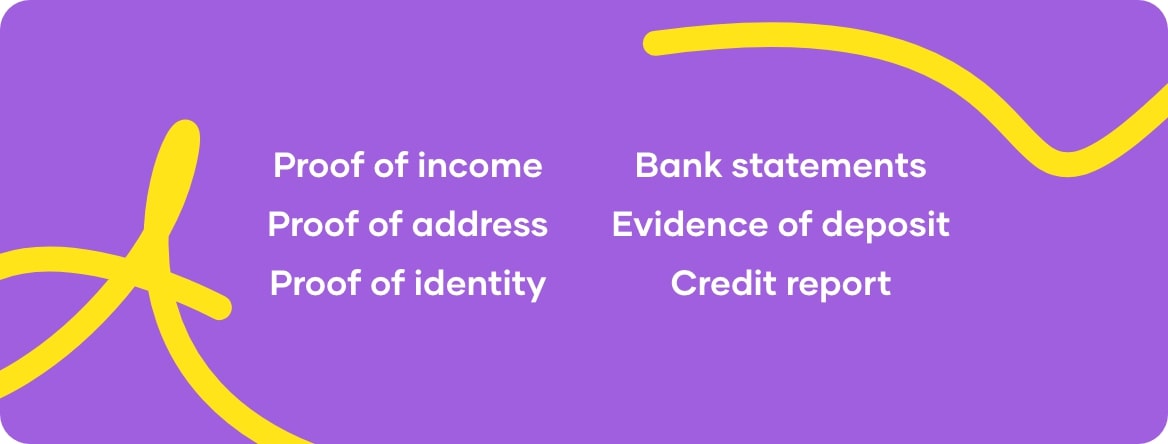

8. What documents do I need for my mortgage application?

9. Household bills to think about when planning how much you can afford:

- Fixed rate: The interest you’re charged stays the same for a number of years, typically between two and five years.

- Variable rate: The interest you pay can change.

Fixed rate mortgages are useful because they give you peace of mind that your monthly payments will stay the same, helping you to budget. Although, fixed rate options are usually slightly higher than variable rate mortgages and if interest rates fall, you won’t be able to benefit from this.

TIP - Remember, if you are wanting to leave this type of mortgage early there may be charges that you have to pay

In the last two to three months of your fixed period make sure to look for a new mortgage deal or you’ll be moved automatically onto your lender’s standard variable rate which is usually higher.

- Standard variable rate

- Tracker rate

10. Side Hustles: Can they be included in my affordability? About Self Employed Income