The Government's stamp duty tax relief has been extended until September, the Chancellor announced today in the Budget.

The previous announcement about the extension until June still stands, with a gradual fade out from then until the end of September.

Let's explore...

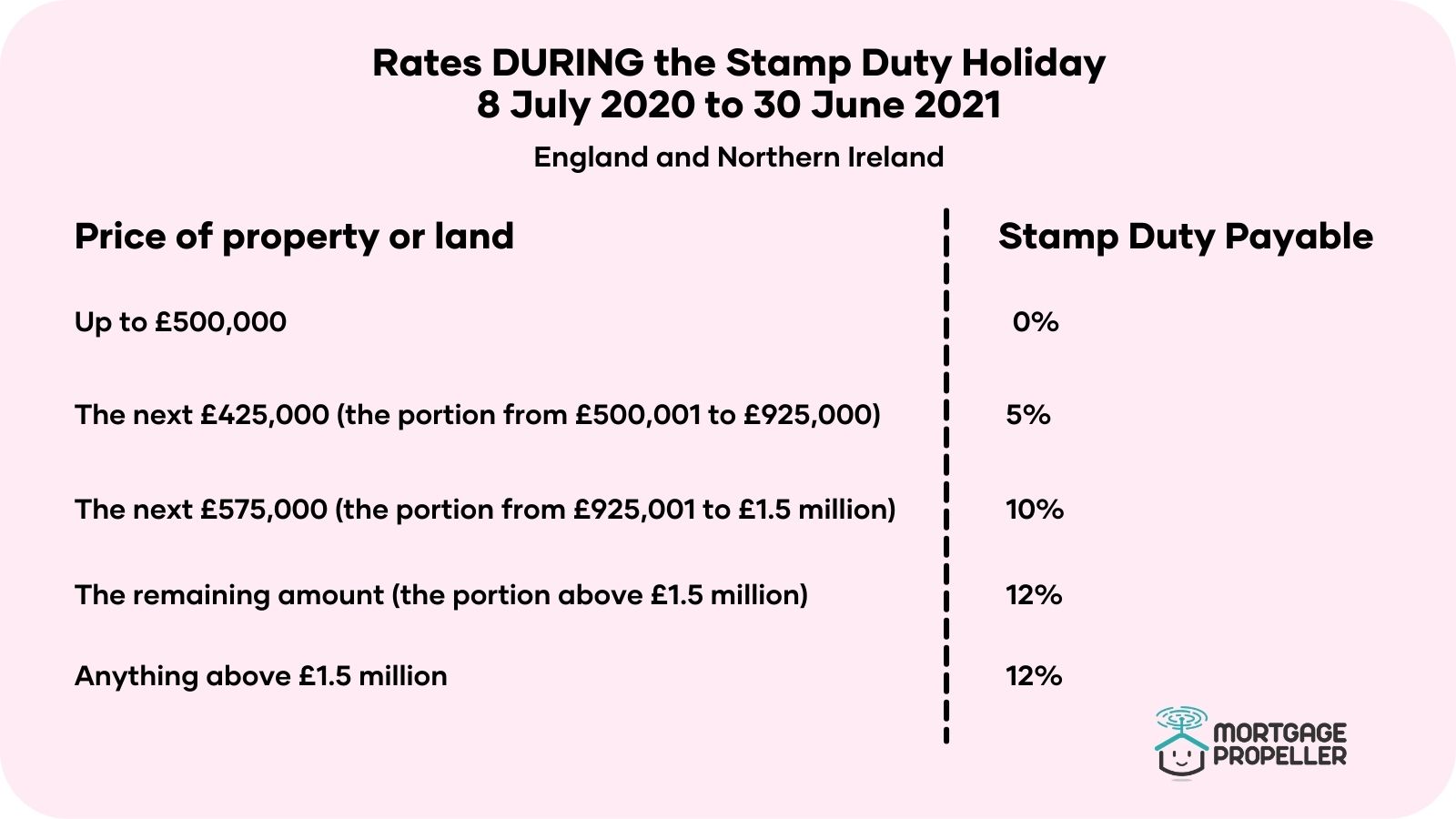

Mr Sunak told the House of Commons: "I can announce today the £500,000 nil rate band will not end on 31st of March, it will end on June 30th.

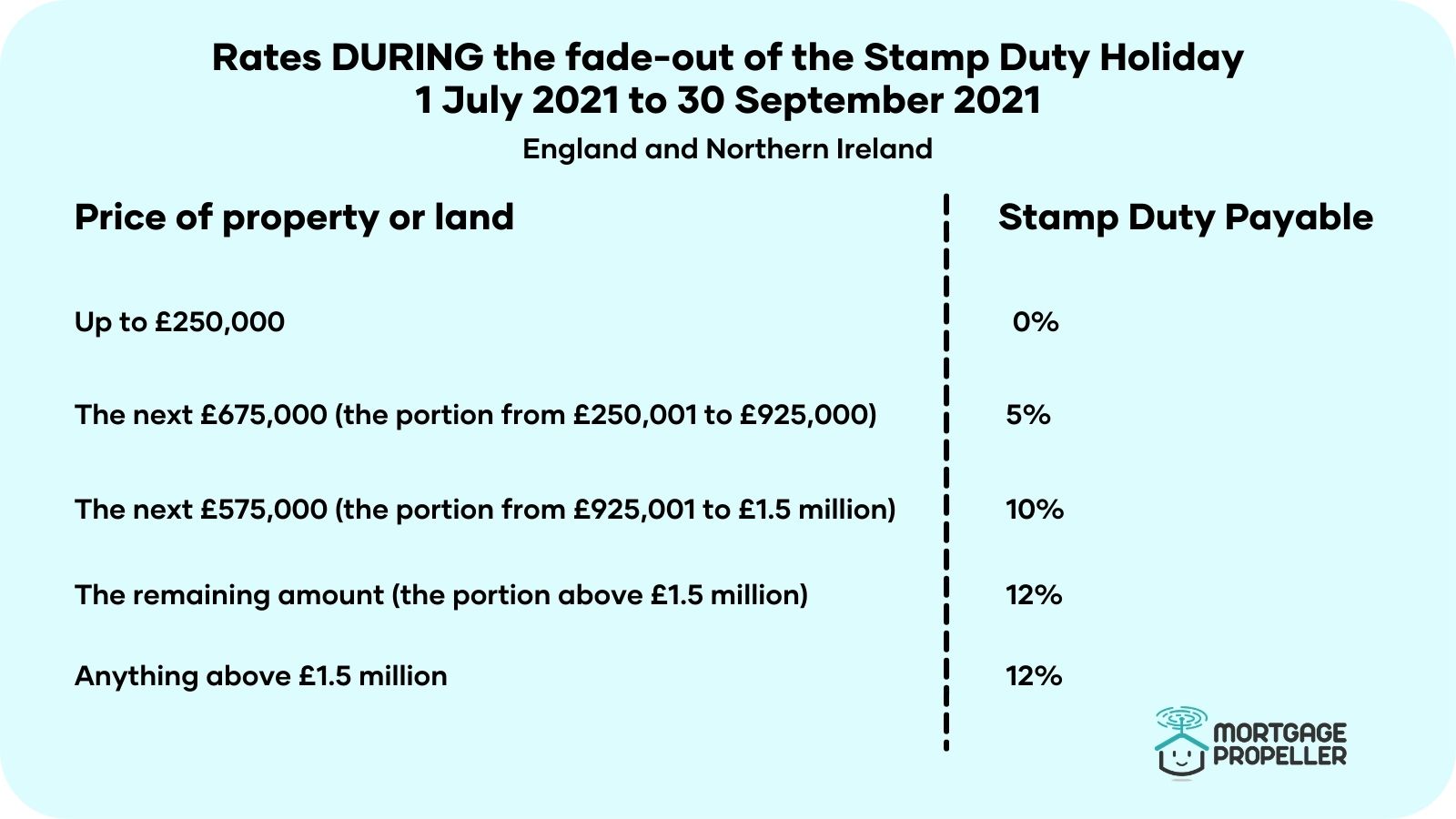

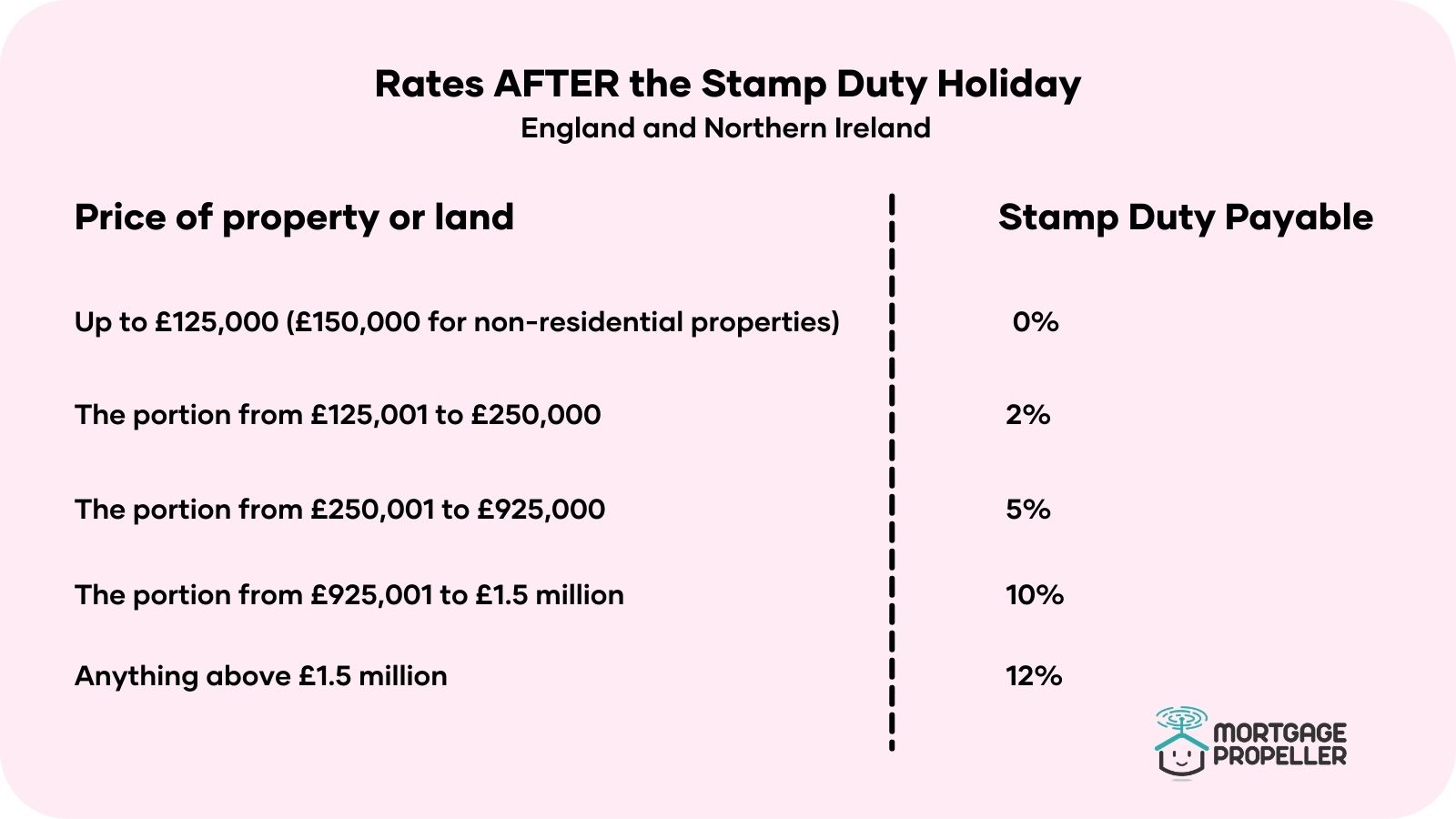

"Then, to smooth the transition back to normal, the nil rate band will be £250,000, double its standard level, until the end of September – and we will only return to the usual level of £125,000 from October 1."

The rates apply to home buyers in England and Northern Ireland only, as they differ for those buying homes in Scotland and Wales.

It means buyers would pay no stamp duty on a £500,000 home if they completed on the sale today. But between July and October, they would have to pay £12,500 and £15,000 from September.

Does that make sense? We'll break it down just in case...

Rather than ending on 31 March 2021, the temporary nil rate band (0% tax to be paid) of £500,000 will be in place until 30 June 2021.

Then from 1 July 2021 to 30 September 2021 the nil rate band will be £250,000.

The nil rate band will return to the standard amount of £125,000 on 1 October 2021.

For in-depth breakdowns and the official information on Stamp Duty and Land Tax, visit: https://www.gov.uk/guidance/stamp-duty-land-tax-temporary-reduced-rates

Alternatively, the government has a handy calculator so you can work out how much you would pay on a property.

Happy home hunting!