The new London 'Help to Buy Equity Loan' means that First Time Buyers in London can now get an equity loan of up to 40% of the property purchase price. But how does it work and are you eligible?

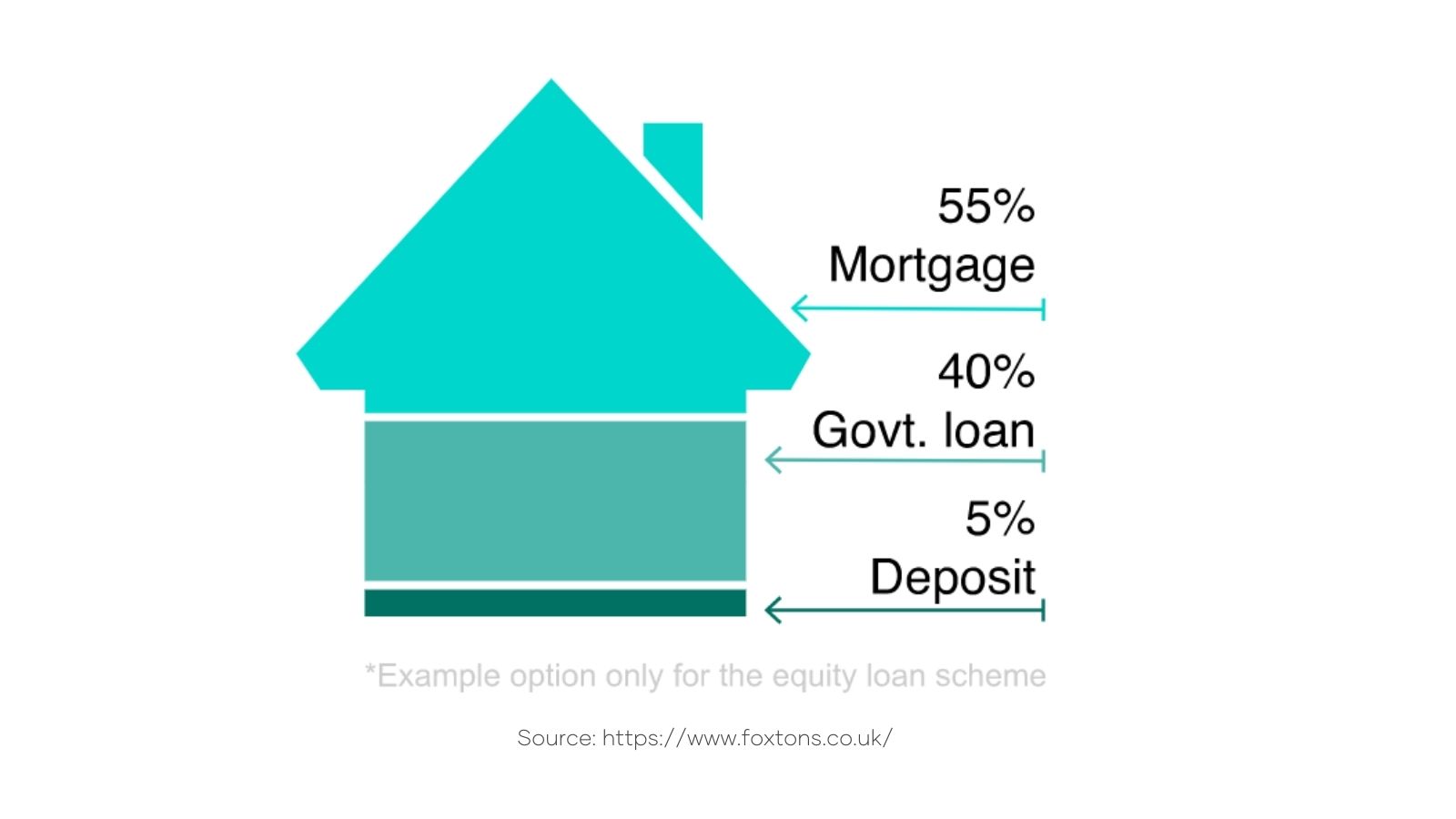

The 'Help to Buy: Equity Loan Scheme' is a Government-backed scheme aimed at helping First Time Buyers get onto the property ladder. With as little as a 5% deposit on your new home, you can borrow a minimum of 5% and up to a maximum of 40% in London. The remainder of the cost is covered by a mortgage.

How does the Help to Buy London Equity Loan work?

- The Help to Buy Equity Scheme is restricted to First Time Buyers

- Purchasing a property through the Help to Buy Equity scheme is restricted to only buy new-build apartments and homes from a homebuilder registered for the Help to Buy equity loan

- Help to Buy in London offers equity loans to buyers looking to purchase a new-build home with a purchase price up to £600,000

- You will need to provide a least a 5% deposit, (5% of the whole property value)

- For the Equity Loan, you can borrow a minimum of 5% and up to a maximum 40% in London. (Only 20% maximum for the rest of England).

- You take a mortgage out for the remaining amount left on the property e.g. Property is £200,000, you pay a 5% deposit of £10,000, you take the full 40% equity loan, which leaves a mortgage of 55% (£110,000 in this case)

- You don't need to pay any interest on the equity loan for the first five years

Who is the Help to Buy London Equity Loan Scheme for?

- You must be at least 18 years old

- You must be a first-time buyer, meaning that you have never owned another property either in the UK or abroad

- You will require at least a 5% deposit of the full purchase price of the property

- You must be able to afford any interest payments, as well as the monthly mortgage repayments

- You must not sublet or rent out the property, it must remain your primary residence after you buy it

What type of properties can you buy with Help to Buy London?

- New build properties within the 32 boroughs of London, including apartments

- Properties up to the value of £600,000

- The new build must be with a homebuilder registered with the scheme

How do I pay back the Help to Buy London equity loan?

- You must pay back the loan after 25 years or when you sell your home - whichever comes first

- You will not be charged any interest on the 40% loan for the first five years of owning your home

- A management fee of £1 a month will be applicable from the date of purchase for the duration of the equity loan

- From year six, a fee of 1.75% is payable on the equity loan, which rises annually by CPI (Consumer Price Index) inflation plus 2%

How much of a Help to Buy Equity Loan mortgage can I afford?

Your affordability is usually calculated by multiplying your annual income by 4 - 4.5 times your salary.

The equation for the Help to Buy London Equity Loan goes like this:

- Property Price = £200,000 (this is 100% of the property value)

- Minimum deposit required = £10,000 (this is 5% of the property value)

- Maximum equity loan under the scheme in London = £80,000 (40% of the property value)

- You take a mortgage out on the remaining value = £110,000 (55% of the property value)

In this scenario, you would need to earn at least £27,000 per year or have a joint annual income of at least this.

The percentages may change depending on the size of the deposit and the amount of equity loan you are required to take. However, the maximum Help to Buy Equity Loan amount in London is 40%, and the minimum deposit required is 5%.

Want to find out more about the Help to Buy London Equity Loan and getting onto the property ladder in London?

Start your mortgage journey online, and connect to a human Mortgage Expert in your area, and get mortgage joy.

Get started here or find out more about How it Works here.