(Read part 1 of this Blog series here)

Do you remember the early part of Covid? The part where toilet roll was like a Willie Wonka golden ticket, schools were closed, and it seemed no one would ever buy a house again. It was a very scary time for everyone and for the property industry as a whole.

But. Like always. The housing market bounced back. Estate Agents innovated and began online viewings. Mortgage Advisors learned you could use Zoom meetings to provide advice as well as do a family quiz and it seemed there was no real change for the industry. If anything, 2021 was a great year for many! But look under the hood and everything was changing….

The Early Digital Channel winners

When Covid-19 sent everyone online, except for L&C, most of the major Networks or firms didn’t have the brand awareness or technical capabilities to acquire and convert online leads. But there were some big winners.

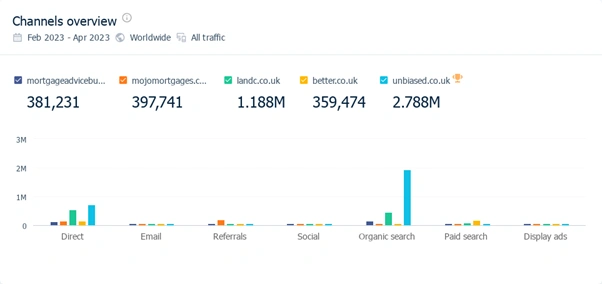

Lead generating site Unbiased.co.uk averaged ~40k monthly organic visitors in 2019. They have since seen a 1200%+ increase in monthly organic traffic and enquiries. More and more advisors turned to Unbiased with the reduction in estate agency referrals. As broker demand increased for Unbiased’s leads so too did the cost of purchasing these leads by ~320%!!

This trend continued. In April ’23, CEO and Founder Karen Barret announced a record month for mortgage enquiries and with £10.6m of investment from YFM Private equity since the turn of the decade, Brokers should expect to have to rely on Unbiased with the cost and growth of such leads to grow.

Unbiased.co.uk monthly organic traffic growth since inception (Source: SEMRUSH)

The owners of numerous other leads generating websites (e.g., onlinemortgageadvisor.co.uk) have also benefitted significantly with similar exponential growth in their organic traffic over the last 3 years.

What next?

Covid-19 driving exponential growth of online lead generating websites should see 40% of UK Borrowers using an online method to obtain their Broker in the near future - it was 61% in America in 2021 (Source: Forbes)).

40% translates to around 500k Borrowers removed from the traditional sales funnel. 2 out of every 5 of this 500k will refer a friend or family member and 1 out of every 3 will be retained by their Broker according to the same FCA’s surveys. Soon 860k mortgages a year, about two-thirds of the market, will begin with digital acquisition. Who is going to get these 860k mortgages?

The early leaders

| Social media | A minority of advisors and firms can hold their own on social media and will benefit for years to come but limited time and expertise make this a challenge for most. |

| Better.co.uk | With a $5bn - $6bn market cap they have unrivalled resources to spend on marketing. They are currently outspending all leading competitors combined for digital ad spend. |

| Mojo | RVU acquired Mojo Mortgages to refer the 7m annual mortgage queries their websites generate (e.g., Confused.com). As the digital channel for acquisition grows so too will their referrals. |

| L&C | One of the few brokerages with a true brand awareness. With Experian as an investor referring, their multiple comparison website relationships and their recent deal with OnTheMarket expect London and Country revenues and lead generation dominance to grow along with the general increase in online lead generation overall. |

| MAB | Currently the only Network that ranks on page 1 of Google Search for the term ‘Mortgage Advisor’. The new MAB digital platform will allow it to chase down L&C and Unbiased in the years ahead. |

_

Looking at some of these early winner by the different channels you can see their strategy in action. Better.co.uk spend. L&C. Unbiased have a brand already built (with MAB also gaining while Mojo's new owners acting as affiliate referrals to drive their lead generation.

3 months of website traffic and channels of acquisition for the online industry leaders from earlier this year (Source: SimilarWeb)

There are others of course. Specialist advisors servicing niche cohorts of Borrowers perform very well on Google search but they can expect increased competition as MAB, Better, L&C etc aggressively pursue the huge prize.

Falling behind… The Stragglers

In the UK, around 75% of the market operate as Appointed Representatives and many of their Advisors are self-employed. Many lack an established client base or access to digital channel lead gen. This group will face challenges as their pipeline diminishes in the coming years, leading to a greater reliance on online lead generation platforms such as Unbiased who will increase their costs of force long term commitments (as we’ve seen of late).

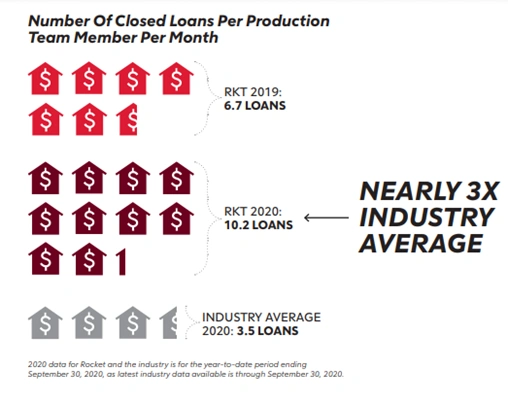

As technology enhances advisor efficiency as did in America, both the no. of advisors and no. of Appointed Representatives will decline. Stronger advisors and firms will seize market share benefiting from a surge in capacity, while weaker advisors will be at a disadvantage. Network profitability will reduce, some smaller Networks may even be acquired as the ongoing consolidation of this fragmented market continues.

Rocket Companies, Inc 2021 annual report - demonstrating how the RocketMortgage.com platform increased the mortgages closed per advisor per month.

Could MAB do to other Mortgage Networks what Rocket Mortgage did to Wells Fargo?

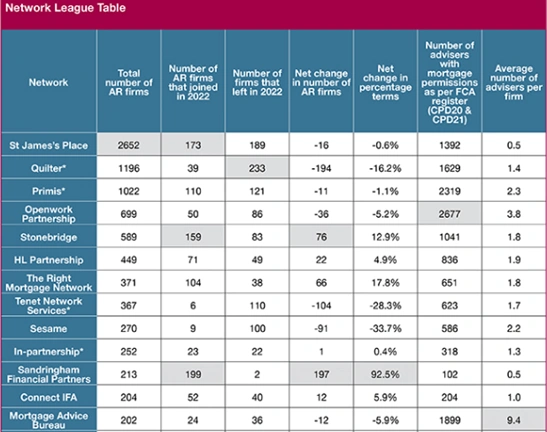

Just as Rocket mortgage were ranked 3rd for volume of annual business in 2016, so too MAB are currently ranked 3rd for no. of advisors with mortgage permissions in the Network tables. The Openwork Partnership lead the way with 2677.

Interestingly, MAB stands out with an impressive ratio of 9.4 advisors per AR firm, indicating their success in growing and addressing lead generation. This suggests that the firms within MAB have made significant strides and are not as far behind the market leader as Rocket Mortgage once was.

Source: Network Consulting via Mortgage Solutions, all data correct as of 31/3/23

Peter Brodnicki was very bullish at MAB's conference last week claiming to be "miles away ahead of the competition". With the exception of L&C I would tend to agree. In Part 3 of this blog series we'll take a closer look at what MAB is doing to build a lead generating machine, comparing their performance against their biggest competitors and how they might just do a Rocket Mortgage on the UK Mortgage and Protection advice industry.

"If that happens, "all the tech in the world won't help Advisors...if they've no clients"

....In Part 3 of this Blog series we’ll take a closer look at Mortgage Advice Bureau's efforts versus other Networks.

__

Mortgage Propeller is an On-Demand Services Platform for Mortgage Firms and Advisors. Its proprietary technology was developed and validated by £280m of enquiries from 3000+ Borrowers, 40+ Advisors and 20 firms over the past 3 years to solve lead gen and admin challenges. .

Mortgage Propeller is seeking Partners/Advisors/Collaborators for it's 2024 January lead gen PiIot. We are particularly interested in hearing from Firms & Networks who'd like to learn more about our Digital solutions. Email matt@mortgagepropeller.com to express interest.