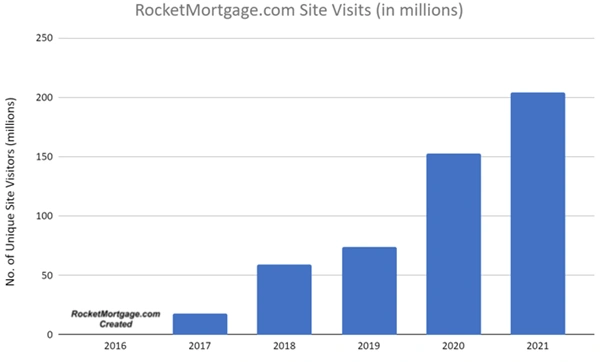

America. 2009. Quicken Loans are arranging 1 out of every 100 mortgages. In 2020, trading as Rocket Mortgage, it was arranging 1 out of every 10 as their market valuation topped $40bn following an IPO. Not bad considering they only launched RocketMortgage.com in 2016

The success of Rocket Mortgage and the move by consumers to Digital channels to find their Mortgage Advice is being replicated in the UK. By 2030, two-thirds of all advice in the UK annually will have originated online – its already overtaken referrals from estate agents. Now that some of the big players (think Better, MAB, Mojo, L&C…) are accelerating their Digital lead gen strategies, the traditional local Mortgage Broker might just find itself wondering ‘Where did all my clients go?’ while Networks might wonder 'Where did all our members go?'.

In this Blog series we'll unwrap how digital lead gen is going to change the face of online advice forever.

The Rocket Mortgage story

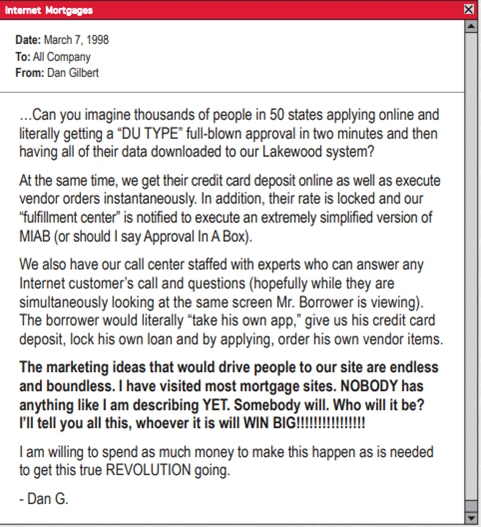

Rocket Mortgage’s CEO, Dan Gilbert, famously emailed all his employees in 1998, setting forth the vision for Rocket Mortgage. A web facing digital platform serviced by advisors from a central low-cost location:

Source: Rocket Companies, Inc 2021 annual report

In that email Gilbert said, “the marketing ideas that would drive people to our site are endless and boundless”. The success of the RocketMortgage.com platform suggested he was right.

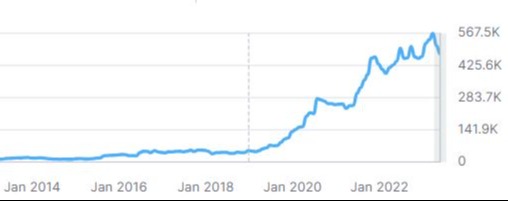

Source: Rocket Companies, Inc annual reports

Gilbert backed up his 1998 commitment to spend to deliver results. With a significant marketing budget and huge affiliate network, combined with the acquisition and creation of multiple other platforms and websites (RocketHomes.com, ForSaleByOwner.com, Rocketauto.com, Rocketsolar.com, lowermybills.com, Rocketmoney.com …), Gilbert was able to disrupt the US mortgage industry.

Disruption of the US Mortgage market

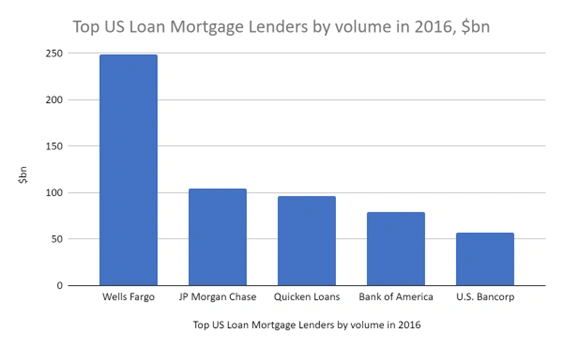

Wells Fargo dominated the US mortgage market, relatively unchallenged, for two decades. Such was their dominance, regulators often voiced concerns about the systemic risk. When Rocketmortgage.com was launched in 2016, Wells Fargo looked untouchable.

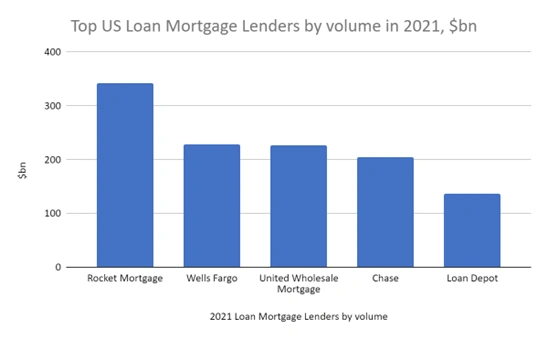

Source: Home Mortgage Disclosure Act data

Following 5 years of innovative lead generation and website traffic, RocketMortgage overtook the 170-year-old institution.

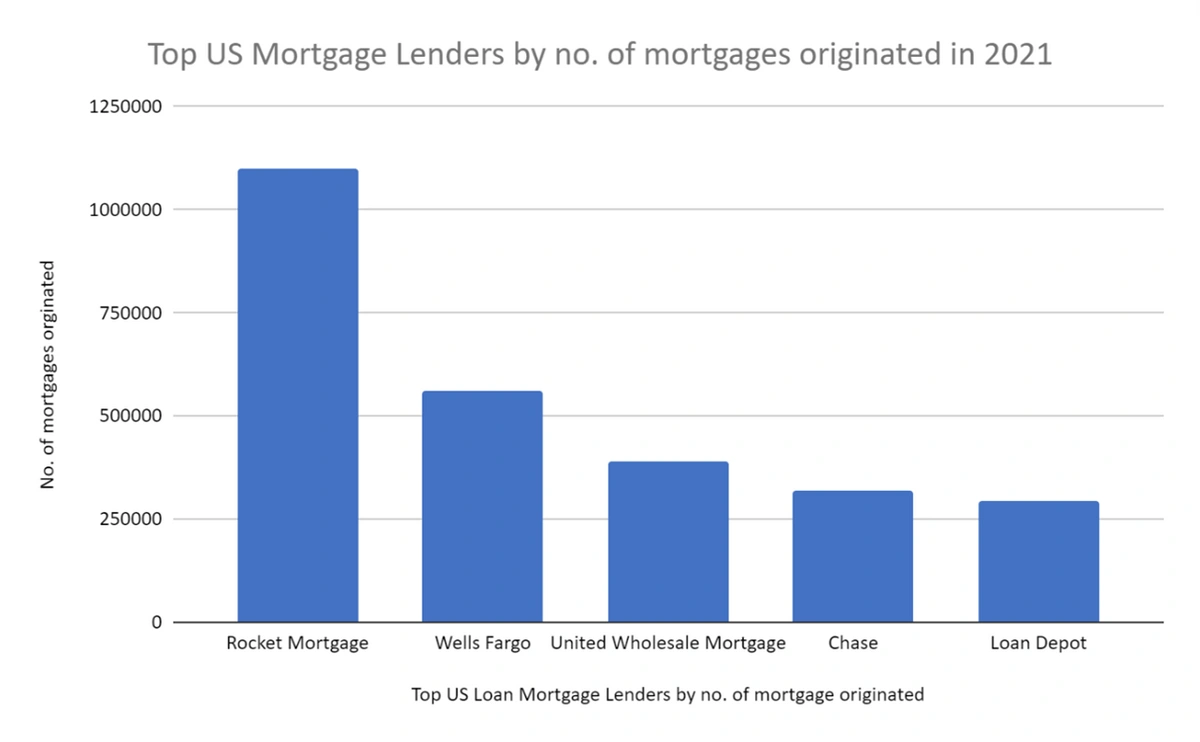

Source: Home Mortgage Disclosure Act data

What’s more striking than Rocket’s rapid rise to the no.1 position for volume of mortgages originated, was the no. of borrowers they provided mortgages for. In 2021 they managed to do twice the no. of mortgages of Wells Fargo.

Source: Home Mortgage Disclosure Act data

Earlier this year the unthinkable happened. Unable to compete with Rocket’s lead generation capabilities, client retention capabilities and the lower operational costs of Rocket’s centralised Detroit workforce, Wells Fargo announced they would be reducing their presence and taking a major step back from the market.

if 'Rocket' was able to do that to an institution like Wells Fargo how many individual Mortgage Advisors and small firms must it put out of business? Well Fargo has a branch in every town of note across America. They were so big less, than a decade ago there were discussion at the Senate and concerns at the SEC (equivalent to our FCA) that they posed a systemic risk to the American economy, such was their dominance in the Mortgage market. But a good website backed by tech took them down.

Could the same happen in the UK? Is there any 'institutions' primed to fall in the years ahead?

Digital Lead Generation in the UK

Digital disruption is already under way in the UK, albeit more subtly. Networks don’t seem to have noticed the move to digital with the notable exception of Mortgage Advice Bureau.

There have always been two main channels for acquiring a new client; Word-of-mouth referrals from an existing client - which account for approx. 39% of all acquisitions (Source: FCA Financial Lives Survey) and referrals from estate agents. The latter has been the foundation of many successful firms and Networks, but this has changed.

The estate agent acquisition channel is deteriorating. The FCA’s 2022 Financial Lives survey reported a 43% drop in borrowers with a mortgage who found their mortgage Broker via an estate agent compared to 2017 - 110k less estate agent referrals annually.

The same FCA survey saw a 117% increase in the no. of Borrowers finding their Mortgage Advisor Online, about 220k annually, since 2017.

While the UK public was slow to follow the trends of their American cousins, the global pandemic has acted as a catalyst for digital acquisition channels turning subtle flows of digital usage for acquisition into a Tsunami that’s changing the UK Mortgage and Protection Advice industry forever….

....In Part 2 of this Blog series we’ll show who the early winners are from this digital disruption, compare what the big players are doing and explain why some Networks and Advisors should be worried!

__

Mortgage Propeller is an On-Demand Services Platform for Mortgage Firms and Advisors. Its proprietary technology was developed and validated by 3000+ Borrowers, 40+ Advisors and 20 firms over the past 3 years to solve lead gen and admin challenges.

Mortgage Propeller is seeking Partners/Advisors/Collaborators for it's 2024 January lead gen PiIot. We are particularly interested in hearing from Firms & Networks who'd like to learn more about our Digital solutions. Email matt@mortgagepropeller.com to express an interest in the Pilot.