If you are ready to purchase your first property, you have more than likely been reading about the importance of your credit score.

Many eager first time buyers might get a shock when they realise how much of an impact their credit score can truly have on the mortgage deals offered them by lenders, and what role it plays in the mortgage application process.

It is important that everyone, who wants to purchase a property in the foreseeable future takes some time to review and manage their credit score.

Improving your credit score doesn’t have to be hard, with the right attitude, resources and a little bit of commitment, you can not only easily increase your borrowing power, but also potentially save yourself thousands in future interest rates.

What exactly is a credit score, and how is it calculated..?

A credit score, also commonly referred to as a credit rating, is a number that defines your creditworthiness. Simply speaking, it rates your spending and borrowing habits on regular basis to give lenders a better snapshot of your reliability as a borrower.

There are five main factors that influence your credit score:

- Payment history, or whether you’ve been repaying any loans or debt on time.

- The Amount you owe, or how much debt (if any) you still have to pay off.

- Length of your credit history

- Any new additional credit you apply for

- The types of credit you use

Your credit score is then determined by credit scoring models, that look at all of the above factors, and combine them to make a number that represents how you perform in each category. Your credit score will be calculated by a credit reference agency such as Equifax, Experian or TransUnion.

Unlike popular misconceptions, there is no one credit rating agency or score that is more trustworthy than another. Lenders normally rely on multiple score models, and will make their own judgement on whether to give you credit and each lender will have an independent approach to scoring your credit profile.

However, common scoring models offered by companies such as Experian or Equifax, are still a useful tool that enable us to judge our credit score independently. The higher the score is, the stronger your application will be when applying for a mortgage - even if lenders have their own assessment criteria.

Connect with award winning FCA Authorised Mortgage and Protection Advisors, receive tailored advice and save on your mortgage.

Get in touch:

Mortgage and Protection Advice is provided by Mortgage Joy Limited (FCA: 955439)

How to check your credit score.

There are four main credit score agencies in the UK - Experian, TransUnion, Equifax, and Crediva. You can check your credit score for free directly on their company websites, or alternatively use a third party credit rating tool that relies on one of the above scores.

For example, many people who are on their credit score building journey might benefit from a convenient platform or an app which will be able to clearly present their credit score history and what has influenced it, and therefore decide to use a third party tool which will give them personalised suggestions to help them improve their credit score over time.

Companies such as ClearScore, work by using a credit score provided by one of the main credit score agencies - in this case, Equifax, to neatly present your credit score through an interactive dashboard.

There is no app that is necessarily better than another, it all depends on your personal preferences. Some may prefer to track their experian credit score and use tools that will enable them to do so. Others may rely more on Equifax, and rely on apps that let them track that, therefore, the choice is completely up to you.

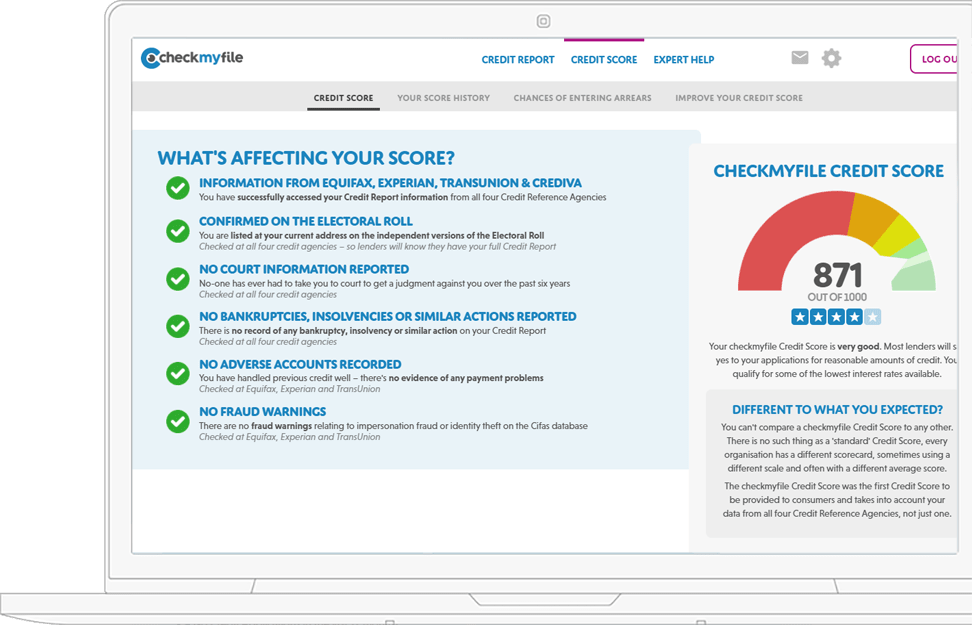

If you would like to view a score from all four of the UK’s main scoring agencies, you can use tools such as checkmyfile. Checkmyfile enables you to see four scores, as well as combining them into an overall number out of a 1000 to help you judge how good your credit profile looks across the board.

How long does it take a build a credit score?

For somebody starting from a clean slate, and only building up their credit score for the first time, it takes an average of six months to establish a score from nothing. However, this does not mean that your credit score will be ideal in six months, you will just have some credit history that credit agencies can report on.

It’s important to remember that initiating a credit score is the easy part, it’s keeping it good for a prolonged period of time or clearly improving it as you go that gives credit companies a true indication of how reliable you are as a borrower, and will help you in the mortgage application process.

What impacts your credit score?

The top five factors that can impact your credit score, as reported by Experian are:

- Payment history - Payment history has one of the biggest influences on your overall credit score. Payment history simply outlines how you have been repaying your debt over time, and whether you have been making payments on time. Missed payments on your credit card or loans can have a severely negative impact on your credit score.

- Amount you owe - The amount of credit you borrow on regular basis is the second most important factor in calculating your credit score. Using over 30% of your available credit for a prolonged period of time can negatively impact your credit score, as it suggests you are reliant on additional finance beyond your income for every day purchases, therefore giving you worse credit rep.

- Credit History Length - The duration of your credit history can also influence your credit score. Simply speaking, the longer your credit history, the better (as long as there is no clear pattern of missed payments or overusing credit) as it gives lenders a better snapshot of your spending habits and creditworthiness.

- Credit Mix -Your credit mix is the amount of the credit accounts you currently hold. These include credit cards, student loan, car loan, mortgage or any other products. People who hold a diverse credit portfolio, give lenders an indication of being able to responsibly hold multiple forms of credit at once, therefore improving their credit score - as long as all of the loans are paid off on time.

- New credit - New credit takes into consideration the number of credit accounts you have recently opened. Someone who may have recently applied for multiple forms of credit, may indicate increased risk, which can hurt their credit score as a result.

What influence does your credit score have on your borrowing power?

Your credit score can have a significant impact on your mortgage application, as much as it is not the only thing taken into consideration during the process.

People with no credit score, or poor credit score can still get a mortgage depending on their circumstances, however it is likely to make the process slightly more difficult.

Applicants can find that a poor credit score, can reduce the amount of lenders who are willing to give them a mortgage, require them to put down a higher downpayment, and increase their monthly mortgage repayments as they are more likely to be offered mortgage deals with higher interest rates.

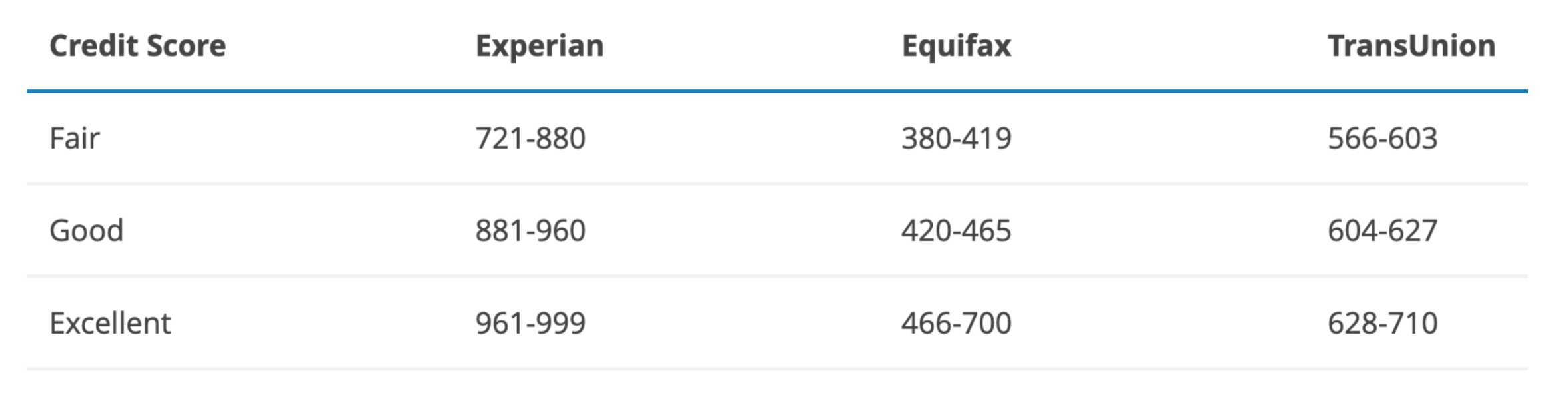

According to a report by Barclay’s Bank, you can identify the strength of your credit score by looking at the following brackets, which are a vague industry standard across the main credit agencies:

People with an ‘excellent’ credit score, as according to the table above, are likely to be offered higher value mortgages, and reduced interest rates.

Can a positive credit score make my mortgage cheaper?

The short answer is yes. As much as your credit score is not the sole determinant of whether you should be eligible for a mortgage or not, it plays a key role in showcasing your creditworthiness to a lender.

As a mortgage tends to be the largest loan many people will take out in their lifetime, a strong credit rating will prove to lenders that you are a reliable and trustworthy borrower, who is well experienced in handing any previous debt or loans, and can therefore make their repayments on time.

Mortgages, alongside other loans are always risky to lenders, who can never be a 100% sure that they will get their money back in a timely manner. Therefore, higher risk factors, such as a poor credit score forces them to give out loans with less favourable conditions for the borrower, that will give them additional safety.

This means that someone with an excellent credit score is likely to be offered a higher loan value, as well as lower interest rates which will help decrease the price of the mortgage, saving them money in the long run.

How to improve your credit score

Taking into consideration all of the factors that influence your credit score, will help you build a better picture of how to improve it. It’s important to remember that some things that influence our credit score are just taken out of our hands, such as credit history length.

If you are eager to take out a mortgage next year, however, have only just been using a credit card or paying off a loan for a year, your credit score may not be as strong as someone who has an immaculate ten year credit history, and that’s okay.

Looking at the points below, and making improvements where possible, may be effective in helping you to improve your credit score for the time being:

1. Get on the electoral roll

Register on electoral roll on the gov.co.uk site. This data helps lenders easily confirm your legal name and address, and can positively influence your credit score.

2. Check your credit files

Request a copy of your credit file from the main four credit reference agencies - Experian, TransUnion, Equifax, and Crediva. Check your file for any errors and add a notice of correction by contacting the relevant credit agency if necessary.

3. Close old joint accounts

If you have previously had a joint account with a partner that you are no longer together with, contact the bank and request to be delinked from them, or simply close the account to avoid their credit history from affecting your applications.

4. Consider your timing

Legal matters that can influence your credit score, such as court judgements for unpaid bills. These are wiped from your record after six years, so if you are currently under legal action, you may want to consider applying for the mortgage in the future when it will no longer influence your score.

5. Don’t withdraw cash from a credit card

Withdrawing cash directly from you credit card can reduce your credit score by suggesting that you are using your credit for necessities.

6. Make sure you repay any loans or debt on time

It’s really that simple. A history of poor loan or credit card repayments will bring your credit score down massively, therefore one of the main ways to improve it is to implement smart budgeting tactics and paying everything off in a timely manner to start rebuilding your creditworthiness.

7. Pay off any remaining debt

Do you have credit card debt that has been lingering for too long? If you have any loans or debt that you know you could pay off faster, start paying it off in bigger instalments to clear your accounts, as this can help bring your credit score up.

8. Don’t acquire additional debt

Before applying for a mortgage, resist the temptation to use your credit card for silly spending or to take out unnecessary loans.

All of the tips above may help you build a stronger credit score over time. If you would like to receive mortgage advice or figure out what type of mortgage may be best for you based on your credit score and current living situation, arrange a free call with one of our experienced Mortgage Brokers, and gain clarity on the best options available to you.